What are Personal Loans?

Personal loans are somewhat unstable loans presented by all the top loaning organizations. The loan is accessible on the web and can be profited from the solace of one’s home or office. The financing cost charged for this loan is a piece high than others which drives you to thoroughly consider it before you put it all on the line. In any case, there is no closure use limitation on it and can be profited for any crédit personnel need.

What are Home Loan top-ups?

A Top Up Loan is an extra loan that you get from your home loan bank far beyond your current home loan. The loan requires insignificant documentation as you as of now have a current record with the bank.

With Top Up home loans you can redesign, broaden or do some other sort of development or remodel work for your home. Notwithstanding, there are end-use limitations yet the greatest aspect of it is the financing cost for a top-up personal loan is equivalent to that of home loans which makes it helpful for the clients.

Loan cost

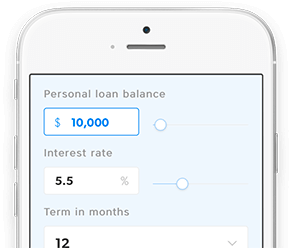

A top-up home loan is dependably on your generally existing home loan. Furthermore, the benefit of deciding on it is – you get a top-up home loan at a similar financing cost at which you have your continuous home loan. This makes your acquiring way helpful and reasonable for the buyers. One more significant highlight realize here is – the loan specialist thinks about your home as insurance and doesn’t request that you give extra security likewise you get it at a less expensive rate. While when you profit a personal loan its financing cost is in every case high and regularly comes at 10-16%. In any case, a personal loan is secure and you won’t need to give any security/guarantee for it.

The residency Period

Home loans are for the most part presented for a residency time of 20 to 30 years, and if you decide on a top-up loan above it, you can get an expansion on the loan residency for around 5 to 7 years. Notwithstanding, for a personal loan, you can get a most extreme loan residency of as long as 5 years. Along these lines, as far as reimbursement top-up home loans offer you better adaptability.

Loan disbursal time

For a top-up personal loan, the loan disbursal, by and large, requires 4-5 days. This is because it is a gotten loan and your moneylender needs to refresh the desk work which was finished at the time you benefited from the home loan. Nonetheless, on the off chance that you are in a crisis and need pressing asset payment, a personal loan is your most ideal choice. A large portion of the banks today give moment personal loans and the cash is credited into your record inside the space of hours through internet handling. With negligible documentation. If you want cash direly, you can decide on a personal loan.

End-use constraints

At the point when you benefit from a personal loan, you have no closure use limitations on it. You are allowed to utilize the cash acquired anyplace according to your prerequisites. However, on the off chance that you profit from a top-up home loan, there are sure end-use limitations related to it.

In any case, among every one of the distinctions, the main point is-a a top-up home loan must be profited by the people who as of now have a current home loan. While anybody can profit from a new personal loan and can meet his/her monetary necessities. Nonetheless, if you as of now have a home loan and going through cash crunches remember to consider factors, for example, the EMI sum and the tax reductions before choosing any of these loans.